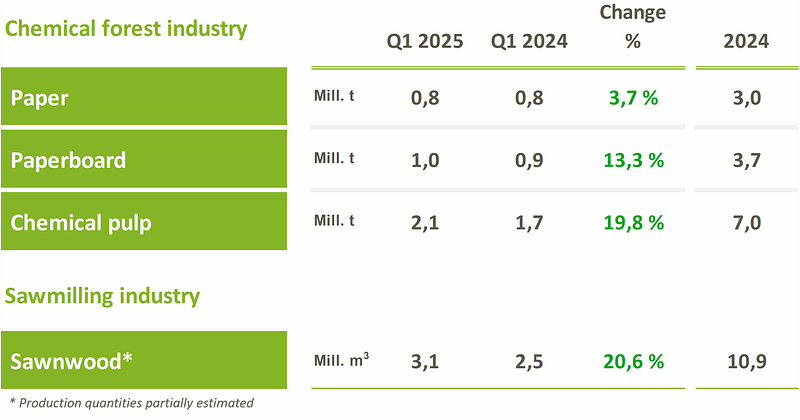

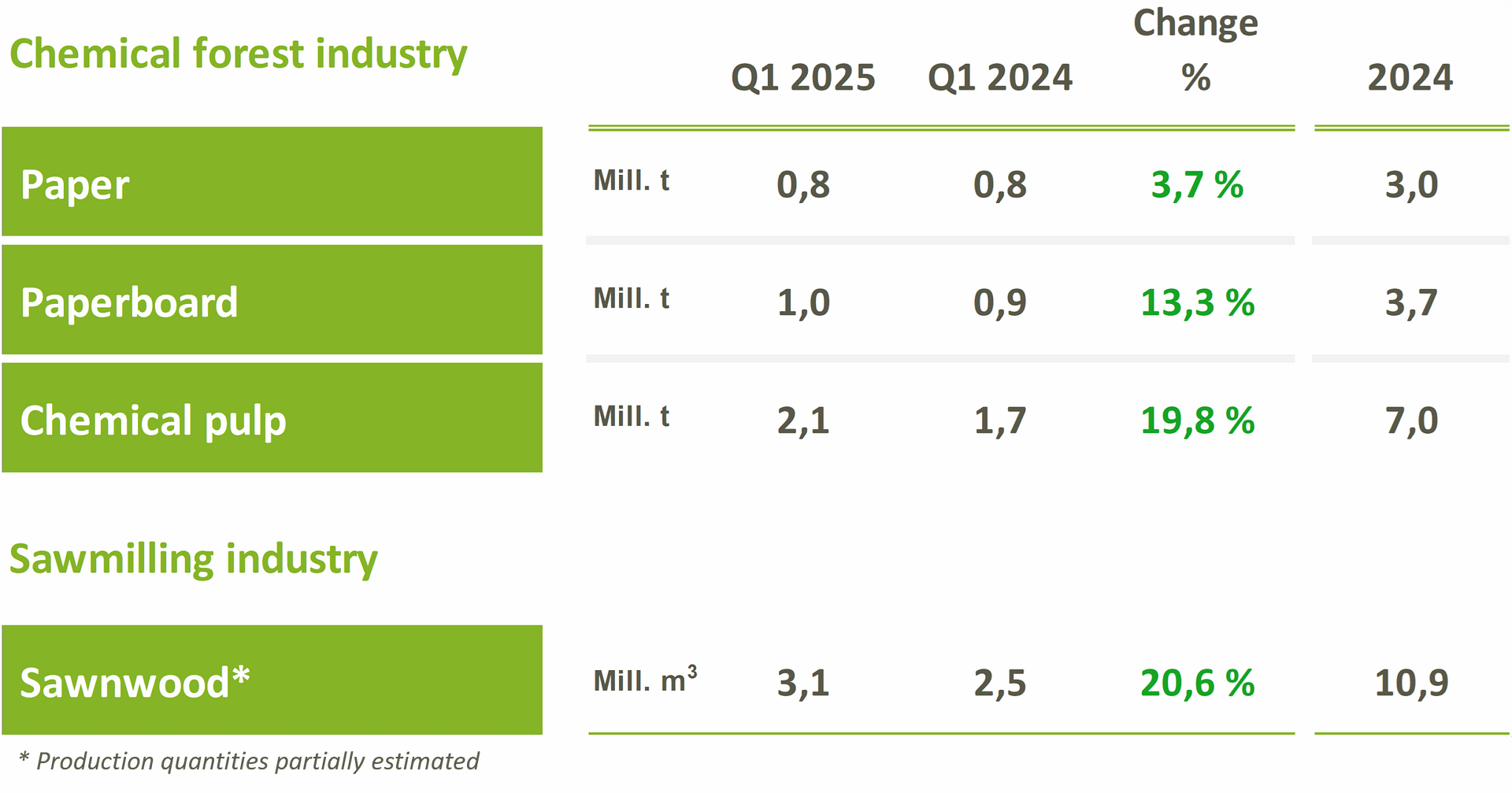

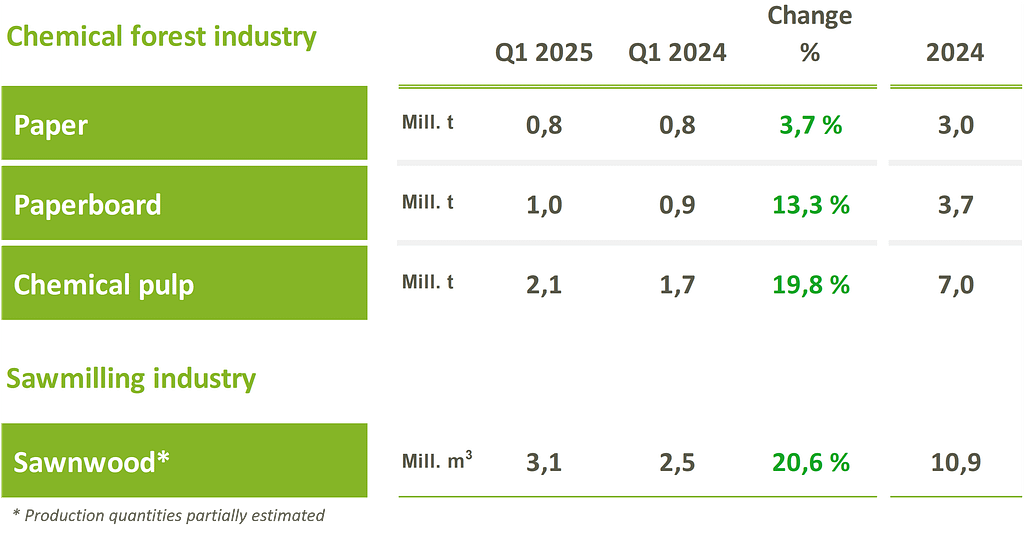

The production volumes of all key product groups in the forest industry increased during the first quarter of the year compared to the same period last year. Paper production rose by 3.7 % at the beginning of the year, with 0.8 million tonnes produced in the first quarter. Cardboard production grew by 13.3 %, reaching 1.0 million tonnes. Pulp production amounted to 2.1 million tonnes in the first quarter, marking a 19.8 % increase from the previous year.

The production of sawn timber also increased significantly compared to the same period last year. In early 2025, 3.1 million cubic meters of sawn timber were produced, which is 20.6 % more than during the corresponding period last year. The production figures for the reference year were affected by political strikes that partially halted operations at factories in Finland.

Production volumes in all product groups also rose compared to the last quarter of the previous year. Despite the recent improvement, the overall economic outlook for the forest industry remains weaker than usual.

Forest industry exports higher than a year ago

According to recent foreign trade statistics from Finnish Customs, the value of forest industry exports in the first quarter of the year was 3.2 billion euros. The value of pulp and paper industry exports was 2.3 billion euros, and wood product industry exports, including furniture, amounted to 0.8 billion euros. Export value increased by 20.4 % compared to the same period last year. Political strikes at ports that began in March last year affect the comparability of export figures.

Increased uncertainty in the operating environment has darkened economic prospects

Due to U.S. President Trump’s tariff policies, economic uncertainty has increased, and this is reflected in the economic outlook for the forest industry. More concerning than the direct effects of tariffs are their indirect consequences on trade flows, consumer behaviour, and thereby the demand for forest industry products.

– “In the storms of the global economy, it’s easy to understand the Finnish forest industry’s desire for stable, predictable, and rules-based global trade. I believe most players in global commerce share this view,” says Maarit Lindström, Chief Economist and Director at the Finnish Forest Industries Federation.