President Trump’s tariff policy has pushed international trade into an unprecedentedly turbulent era. We have entered a contest where trade policy is used as a tool to achieve objectives beyond purely trade-related goals. Speculation about the state of play between the U.S. and its trading partners has been abundant—and unfortunately, it will continue.

What does this mean for the forest industry?

Does Finland suffer more or less from tariffs compared to other countries? Are the tariffs imposed on forest industry products an advantage or a disadvantage for us relative to other nations? What kind of relative tariff benefit or burden do Finnish forest industry companies face when competing in the U.S. market?

The situation has shifted rapidly over just a few months. In the first round, at the end of July, the EU and the U.S. reached an agreement on tariffs. To use tennis terms, the U.S. took a 15–0 lead: EU products were hit with a 15% tariff without any counter-tariffs. However, the agreement was only a rough framework and included several exceptions. More exceptions have since been added, while some have been removed.

- Paper and board products have faced a 15% tariff in the U.S. throughout the review period, causing a slight relative disadvantage for Finland compared to competitor countries. These exceptions for competitors were removed in October, restoring the relative position of Finnish products.

- Wood products were initially exempt from tariffs due to a national security investigation, but from mid-October onward, they too have been subject to tariffs. Finland retained a relative advantage because tariffs on Canada—the largest exporter of wood products—were even higher.

- Pulp products were initially subject to the EU’s general 15% tariff, but in September, a presidential order removed these tariffs, restoring their previous zero-tariff status.

Overall, Finnish forest industry exports to the U.S. have enjoyed a slight relative tariff advantage compared to competitors. Keeping track of this? Exactly—it is complicated.

In reality, tariffs have likely only benefited the U.S. federal treasury. Tariff percentage comparisons do not account for indirect effects, which have been far more harmful than individual decisions. Tariff policy has increased uncertainty, curbed consumer behaviour, raised import prices in the U.S., and weakened private consumption, especially in advanced economies. Economic growth has slowed, and forecasts have been revised downward.

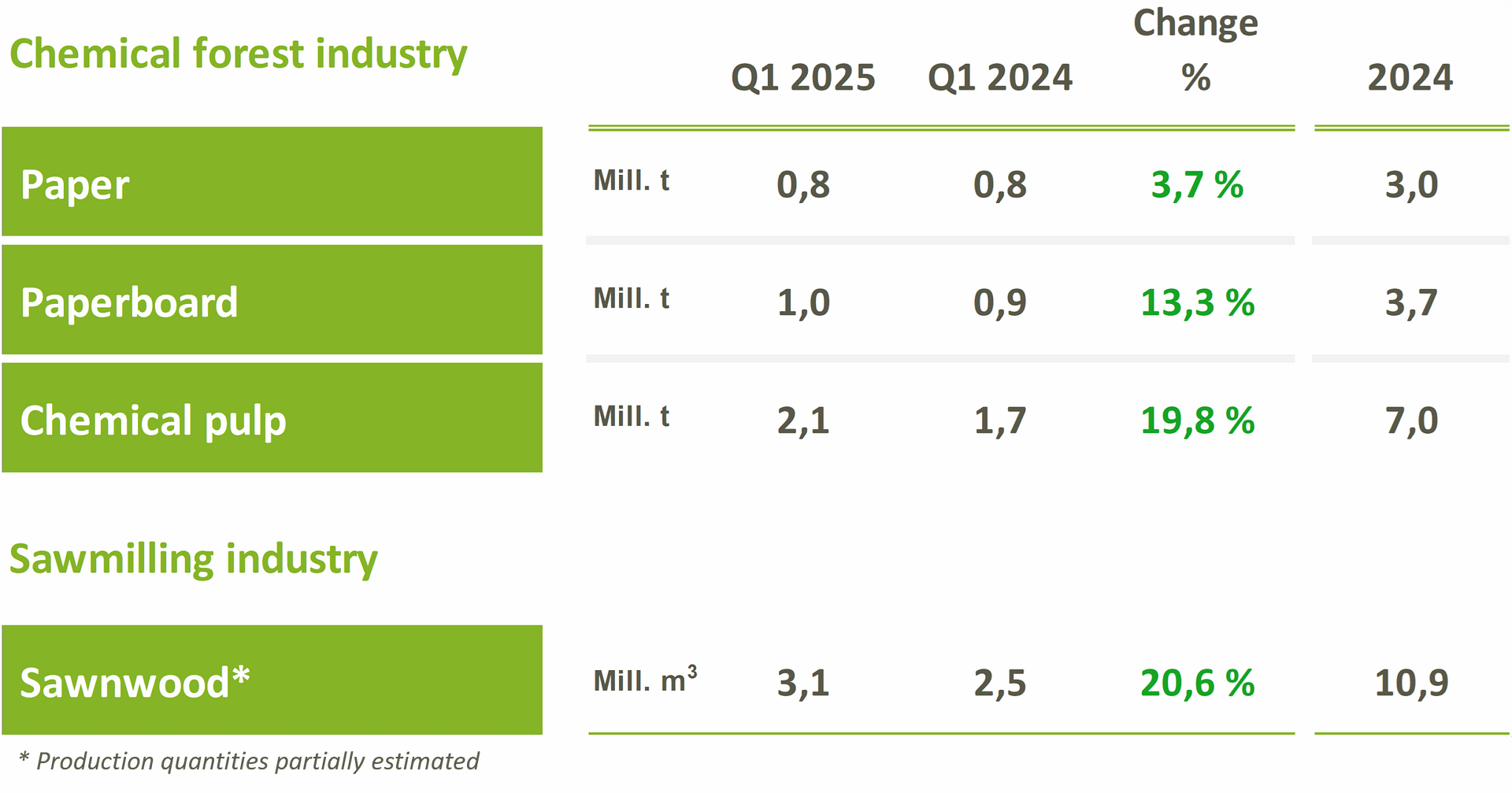

The greatest threat to the forest industry and the EU, however, is the potential and largely invisible re-routing of trade flows. Early in the year, forest industry exports were higher than last year and above the three-year average. Exports to the U.S. were strong early on, as companies sought to ship goods before tariffs took effect. In recent months, however, both overall foreign trade and exports to the U.S. have weakened. Predicting changes in trade flows is difficult. What is clear is that in a world accustomed to free trade, goods will find a new route—like a river carving a new channel.

One casualty of the trade war is China, whose economic growth has slowed. The upcoming deadline for U.S.–China tariff negotiations could again shift the competitive landscape. China’s weakening domestic demand forces the country to focus on exports, which may increase market competition and put pressure on European production. There are already signs that paper and board products from China are flowing into European markets.

The big question is whether the EU needs to respond to these shifts caused by tariffs. While the EU has traditionally defended free trade, it is not impossible that it may resort to trade defence measures in the future. For this purpose, the EU has prepared instruments such as the Anti-Coercion Instrument, which has not yet been used.

The situation is likely to remain unpredictable for as long as Trump is president. But tariffs—they are here to stay. We will continue to monitor the upheaval in geoeconomics closely.

(Originally published in Talouselämä on October 25, 2025.)