In the third quarter of the current year, the operating environment for the forest industry remained challenging, and market demand was subdued. Macroeconomic and geopolitical uncertainty, as well as disruptions in international trade, negatively affected consumer confidence, consumer demand, and the global demand for forest industry products.

The economic situation is challenging, and outlooks remain weak

The economic and demand situation for the chemical forest industry remains weak, and the same applies to the wood products industry. The challenging operating environment is putting pressure on the paperboard and pulp markets, and the still sluggish outlook in the construction market is challenging producers of sawn timber and plywood. Production volumes turned downward after the first half of the year, forcing companies to make necessary adjustments in response to market conditions.

Production volumes declined

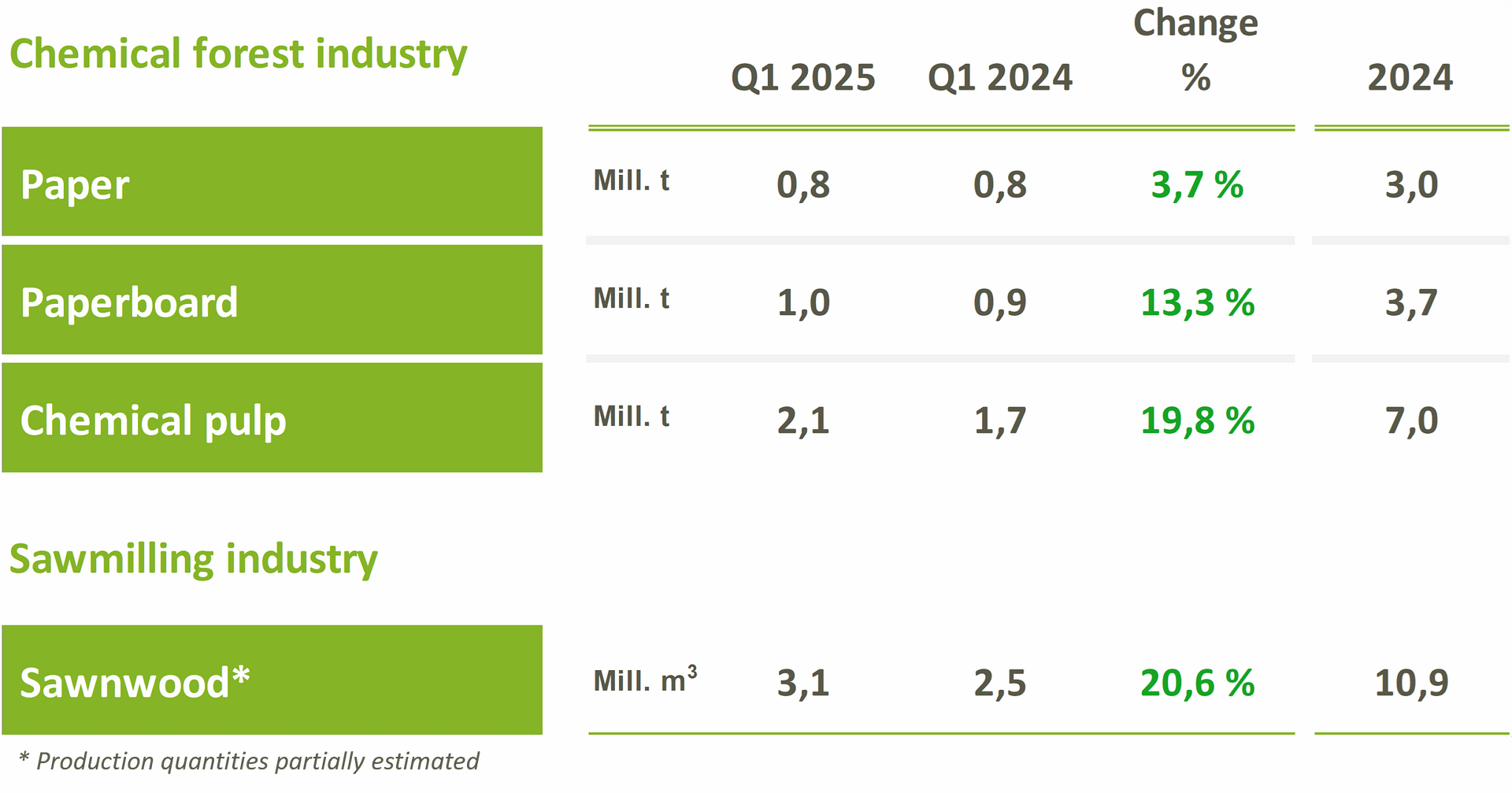

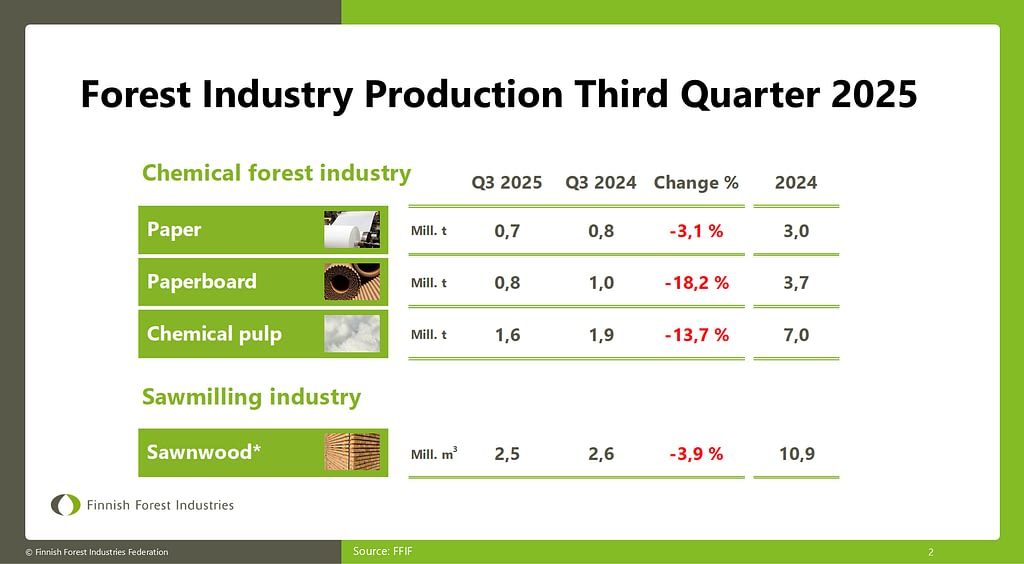

Forest industry production volumes in Finland grew during the first half of the current year, but prevailing uncertainty was reflected in production volumes in the third quarter. Production in all main product groups declined both compared to the previous quarter and to the same quarter last year. In the third quarter, 0.7 million tonnes of paper were produced in Finland, a decrease of 3.1 percent compared to the same period in 2024. Paperboard production fell by 18.2 percent year-on-year, with a total of 0.8 million tonnes produced. Pulp production was 13.7 percent lower than a year ago in the corresponding quarter, totalling 1.6 million tonnes.

Sawn timber production in Finland also declined compared to the previous year. A total of 2.5 million cubic meters of sawn timber was produced, which is 3.9 percent less than in the same period last year.

Exports of forest industry products lower than a year ago

According to the latest foreign trade statistics from Customs, the value of forest industry product exports in the third quarter was 3.0 billion euros. The value of pulp and paper industry exports was 2.1 billion euros, and the value for the wood products industry, including furniture, was 0.8 billion euros. In total, the value of forest industry exports fell by 7.5 percent in the third quarter compared to the same period last year. This was mainly due to a decline in the export value of pulp and paperboard.

– Global economic uncertainty, which has been exacerbated for the industry by the U.S. tariff rally, was also evident in the forest industry in the third quarter. Production volumes of paper, paperboard, and pulp also declined across Europe during this period. The sector is currently experiencing challenging times, but last week there was finally some good news from the EU policy front. The EU’s new bioeconomy strategy is promising and headed in the right direction. There is clearly a growing understanding of the use of renewable, biodegradable, and recyclable materials on an industrial scale as a source of European competitiveness and sustainable growth, notes Maarit Lindström, Chief Economist of the Finnish Forest Industries Federation.